Merging two established organizations is not merely the combination of two operations under one management authority. Successful integration combines, replaces, and transforms diverse processes, systems and organizational structures. Done well, the resulting entity will be distinctly different and ideally much better than the original operations – this is the “synergy” that is goal of most mergers.

During the due diligence phase there is a significant focus on the financial aspects of the deal (and rightfully so). At the same time the economic business case is being refined, leadership should spend equal time preparing for the integration of the two organizations. In our experience, realizing the goal of a well-designed and smoothly executed merger requires mastery of the organizational challenges – below we highlight a few.

Insight: The Black Box Challenge

Most organization work as they currently exist. Demands are made and results are produced. The problem is that no one really knows how the organization does what it does. The organization is essentially a black box. Why is this? Multi-part organizations have few truly “global” roles which see across the entire operation and they naturally accrete over time – history buries details. Technology obscures processes, rules, and assumptions. There are too many moving parts for any one person to know. Things change. Expertise and documentation become outdated.

This is why it is important to spend the time upfront creating a thorough inventory of what exists today in both the parent and target organization. Enterprise architecture tools like the Zachman Enterprise Framework can help inventory and stucture diverse elements and provide multiple ways of viewing the organizational components from abstract goals down through tangible artifacts, systems, data, and processes. The output from this inventory exercise provides valuable insights for leadership at both companies regarding constraints, dependencies, gaps, and issues that form the foundation for the merger-integration effort. Skipping this step or giving it short shrift can result on nasty surprises later on and can undermine the economic business case.

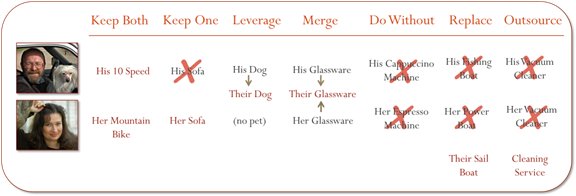

The Challenge of Choice

Merging organizations is like blending the households of two people who have long lived on their own. How do you decide what to keep, throw out, share, or replace? Organizational integration is not just about prioritizing a list of projects. Deciding what capabilities will be retained, replaced, or consolidated should be a collaborative effort among the cross-functional leaders from both companies. Once again, a systematic method is required for assessing the best option for each capability, asset, or program, taking into account practical constraints and strategic goals. The output of the aforementioned organizational inventory can be very helpful in informing these decisions.

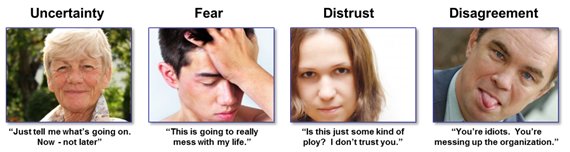

The Buy-In Challenge

For all the talk of embracing change, few people find it an easy or welcome experience. How do you prevent fear, anger, and distrust from derailing a successful merger? There are diverse strong and personally legitimate concerns to address, rooted in what we know about why people resist change.

Simply communicating is not enough to build buy-in for a post-merger integration. There needs to be a robust organizational change management and communications strategy that includes, at a minimum:

- A case for change that creates a sense of urgency for why the merger is necessary

- Engagement strategies that give key stakeholders a role in the merger planning and integration process

- Positioning of the merger among the company’s other strategic initiatives

- A compelling and inspiration vision for the new organization with clearly articulated benefits

- A steady drumbeat of key messages to stakeholders to communicate progress, explain the “what’s in it for me” (WIIFMs)

For senior leaders, the following principles apply:

- Communicate early and often

- Don’t hide; explain plans and reasons

- Listen, then act on what you heard

- Deal with issues immediately

If you are planning a merger or are in the process of a post-merger integration effort and would like an objective perspective, contact us. We would be happy to share our experience, insights, and lessons learned with you.